In the ever-evolving landscape of the financial and banking sector, effective communication is paramount. Timely and secure communication is pivotal in building trust, ensuring transparency, and delivering superior customer service.

In this digital age, where instant communication is the norm, the financial industry has embraced Bulk SMS as a powerful tool to streamline communication processes.

CTA: Looking for a Bulk SMS service provider? Book a no-obligation call with our consultants

This blog delves into the multifaceted role of Bulk SMS in the financial and banking sector, highlighting its impact on customer engagement, security, and operational efficiency. Let’s get started:

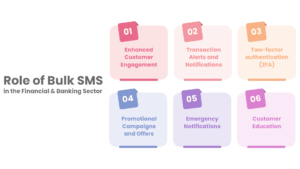

Enhanced Customer Engagement

Bulk SMS is as a game-changer in fostering improved customer engagement for financial institutions. Sending out timely updates on account activities, transaction alerts, and promotional offers via SMS helps banks stay connected with their customers in real-time. This not only enhances customer experience but also contributes to customer loyalty and satisfaction.

Also read: The Major Types of Bulk SMS and How They Work

Transaction Alerts and Notifications

One of the key benefits of the use of SMS in the financial sector is the ability to send instant transaction alerts and notifications. Customers receive real-time updates on their account balances, transaction details, and other important information, providing them with a sense of control and security over their financial activities. This proactive communication also acts as a fraud prevention measure, alerting customers to unauthorized transactions and prompting them to take immediate action.

Two-factor authentication (2FA)

Security is of utmost importance in the financial sector, and SMS services play a crucial role in implementing two-factor authentication (2FA). Banks use bulk SMS services to send one-time passwords (OTPs) to customers’ registered mobile numbers, adding an extra layer of security to online transactions. This method helps mitigate the risk of unauthorized access and ensures that only authorized users can carry out sensitive transactions.

Promotional Campaigns and Offers

Bulk SMS services enable banks to run targeted promotional campaigns and inform customers about special offers, new products, or financial literacy programs. This direct communication channel allows financial institutions to personalize their marketing efforts and reach a wide audience efficiently. By sending promotional messages via SMS, banks can encourage customer participation in various financial products and services.

Emergency Notifications

In case of emergencies, such as system downtime, changes in interest rates, or regulatory updates, Bulk SMS is used to quickly inform customers and stakeholders about the situation.

Customer Education

Banks use Bulk SMS to educate customers about financial literacy, new banking features, and tips for secure online banking. This helps in empowering customers to make informed financial decisions.

CTA: Questions? Get in touch with our Bulk SMS Experts for a free consultation

Advantages of using bulk SMS in the financial and banking sector

Let’s also look at the advantages of using bulk SMS in the financial and banking industry when compared to other modes of communication:

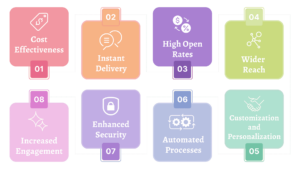

Cost-Effectiveness

Bulk SMS is generally more cost effective than traditional methods of communication, such as postal mail or phone calls. It allows financial institutions to reach a large audience at a lower cost per message.

Instant Delivery

SMS messages are delivered instantly, ensuring that important information reaches customers in real-time. This is particularly crucial for time-sensitive notifications, such as transaction alerts or security updates.

High Open Rates

SMS messages typically have high open rates compared to emails. Customers are more likely to open and read text messages promptly, making it an effective channel for urgent or critical communications.

Wider Reach

Bulk SMS allows financial institutions to communicate with a large number of customers simultaneously. This wide reach is beneficial for disseminating information quickly and efficiently to a diverse customer base.

Increased Engagement

The direct and personal nature of SMS can lead to increased customer engagement. Customers are more likely to engage with and respond to SMS messages, making it an effective channel for promotional offers or surveys.

Enhanced Security

SMS is commonly used for two-factor authentication (2FA), providing an additional layer of security for online transactions. This contributes to enhanced security measures and helps prevent unauthorized access to accounts.

Automated Processes

Bulk SMS allows for the automation of routine communication processes. This not only saves time but also ensures consistent and timely delivery of messages, improving overall operational efficiency.

Customization and Personalization

Financial institutions can customize and personalize SMS messages to address individual customer needs. This level of personalization helps in building stronger customer relationships.

Also check: Bulk SMS Messaging Use Cases in BFSI Industry

To Conclude

In the financial and banking sector, where trust and security are paramount, SMS is an invaluable communication tool. By leveraging this technology, financial institutions can enhance customer engagement, strengthen security measures, and streamline internal operations. As technology advances, Bulk SMS’s role in the financial sector is likely to evolve, contributing to a more connected, secure, and customer-centric banking experience.

CTA: Looking for a Bulk SMS service provider? Book a no-obligation call with our consultants